placer county sales tax 2020

No personal checks will be accepted. Retailers are taxed for the opportunity to sell tangible items in California.

2851 Plan Ladera Ranch Sun Valley Nevada D R Horton Ladera Ranch Ladera Sun Valley

For more information please have a look at.

. Placer County could vote on half-cent sales tax for Highway 65 improvements. On July 31 2020. It was defeated.

Automating sales tax compliance can help your business keep compliant with changing. This tax is calculated at the rate of 055 for each 500 or fractional part thereof if the purchase price exceeds 100. Placer County Recognized Obligation Payment Schedule ROPS 20-21 - Report of Cash Balances July 1 2017 through June 30 2018 Report Amounts in Whole Dollars Pursuant to Health and Safety Code section 34177 l Redevelopment Property Tax Trust Fund RPTTF may be listed as a source of payment on the ROPS but only to the extent no other.

This story was originally published November 3 2020 11. For tax rates in other cities see California sales taxes by city and county. The average sales tax rate in California is 8551.

The December 2020 total local sales tax rate was also 7250. The current total local sales tax rate in Placer County CA is 7250. Placer County CA currently has 345 tax liens available as of February 16.

All cashiers checks must be made payable to the Placer County Tax Collector. One of a suite of free online calculators provided by the team at iCalculator. ICalculator US Excellent Free Online Calculators for Personal and Business use.

See how we can help improve your. More in Letters to the Editor. California City and County Sales and Use Tax Rates.

The 2018 United States Supreme Court decision in South Dakota v. The median property tax in Placer County California is 3441 per year for a home worth the median value of 427600. A yes vote supported authorizing an additional sales tax of 1 for 7 years generating an estimated 256 million per year for general services including law enforcement fire services and code enforcement.

The 725 sales tax rate in lincoln consists of 6 california state sales tax 025 placer county sales tax and 1 special tax. Placer County has one of the highest median property taxes in the United States and is ranked 117th of the 3143 counties in order of median property taxes. The State Controllers Office audited the methods employed by Placer County to apportion and allocate property tax revenues for the period of July 1 2016 through June 30 2019.

While large parts of it have seen recent updates the work is far from done. You can print a 725 sales tax table here. Drug-addicted homeless should be forced into rehab March 13 2022.

The Placer County California sales tax is 725 the same as the California state sales tax. The citys overall sales tax rate would be increased to 825 until 2028 and officials estimate it would bring in 256 million annually. Retailers typically pass this tax along to buyers.

All sales require full payment which includes the transfer tax and recording fee. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be collected. If Citrus Heights sales tax goes up its worth it to shop in Placer County.

These buyers bid for an interest rate on the taxes owed and the right to collect. Placer County collects on average 08 of a propertys assessed fair market value as property tax. The citys overall sales tax rate would be increased to 825 until 2028 and officials estimate it would bring in 256 million annually.

The December 2020 total local sales tax rate was also 7250. Exceptions include services most groceries and medicine. The base sales tax rate of 725 consists of several components.

Has impacted many state nexus laws and sales tax collection requirements. Usually it includes rentals lodging consumer purchases sales etc. The base sales tax rate of 725 consists of several components.

Placer County 2970 Richardson Drive Auburn CA 95603 Dear Mr. The sales tax is assessed as a percentage of the price. City Rate County.

This table shows the total sales tax rates for all cities and towns in Placer. The Placer County sales tax rate is. Auburn California Measure S Sales Tax November 2020 Auburn Measure S was on the ballot as a referral in Auburn on November 3 2020.

The Sales tax rates may differ depending on the type of purchase. The total sales tax rate in any given location can be broken down into state county city and special district rates. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Placer County CA at tax lien auctions or online distressed asset sales.

Rates Effective 07012020 through 09302020. The 725 sales tax rate in Auburn consists of 6 California state sales tax 025 Placer County sales tax and 1 Special tax. The current total local sales tax rate in Auburn CA is 7250.

California has a 6 sales tax and Placer County collects an additional 025 so the minimum sales tax rate in Placer County is 625 not including any city or special district taxes. The Placer County California Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Placer County California in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Placer County California. The main increment is the state-imposed basic sales tax rate.

The minimum combined 2021 sales tax rate for roseville california is. We conducted the audit pursuant to the requirements of Government Code section 12468. Placer County CA Sales Tax Rate.

The Placer County Sales Tax is collected by the merchant on all qualifying sales made within Placer County. The placer county sales tax is 025. 1788 rows California City County Sales Use Tax Rates effective January 1 2022 These.

Placer county sales tax 2020. Placer County in California has a tax rate of 725 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Placer County totaling -025. To review the rules in California visit our state-by-state guide.

Method to calculate placer county sales tax in 2021. The highest number of sales tax measures 129 were on the ballot in 2020 while no sales taxes were proposed in 2010. There is no applicable city tax.

Leaders said they are about nine years.

Gray S Crossing Homes For Sale Teddy Runge Tahoe Mountain Realty Tahoe Mountain Realty Small Lake Houses House Exterior Mountain Modern Home

15 Sophisticated And Classy Mediterranean House Designs Home Design Lover Mediterranean Exterior Mediterranean Exterior Design Mediterranean House Designs

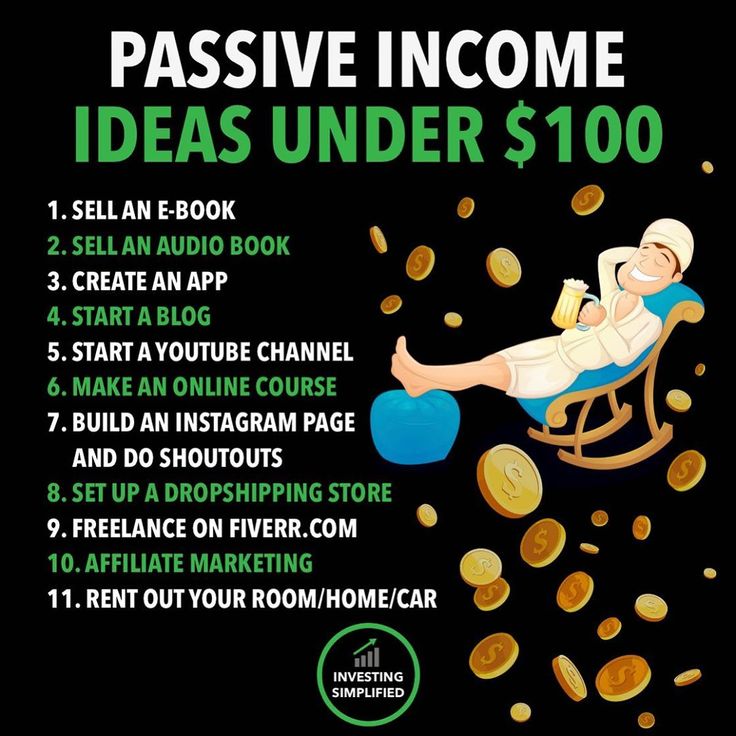

Who Loves Passive Income Passiveincome I Help Local Businesses And E Commerce To Generate Reve Start Online Business Personal Finance Budget Business Money